Novartis AGM Question: Executive Compensation Levels

Question: If Novartis is decreasing in size as a company by 20% to 30% due to the Alcon spin-off will the executive salaries be decreasing by the same amount?

Answer from Mr. Reinhardt: No because we have our peer group. You can read about our peer group in the Annual Report.

Comment: There is no law that dictates what Novartis must pay its top executives, like the CEO, CFO, Head Legal, Head HR, Division Heads, etc. A company can pay whatever it wants. Novartis did this in the past and harvested a great deal of public ire. Thus essentially the question goes to compensation governance.

The Novartis Annual Report describes exactly the process of benchmarking corporate compensation, and the retaining of a Compensation Consultant, the company Mercer, to assist. If Novartis adheres to its own methodologies as described in its compensation section of the Novartis Annual Report then executive level compensation should fall due to the Alcon spin-off.

Let us proffer the following thought experiment: Let us say that Novartis‘ Revenue, Market Cap, Employee numbers and profits double, would the salaries for the executive group remain the same? Obviously not. Those executives know, or at least have a good feeling, and definitely a sense of equity, as to what people (their peers) at comparative sized companies earn. Novartis Executive Committee members and other corporate executives would demand, correctly, that their salaries are adjusted upwards to the appropriate benchmark. If not they become a retention risk, etc.

Novartis has a peer group of companies similar to it. However, with the spin off, its status within that peer group changes downwards.

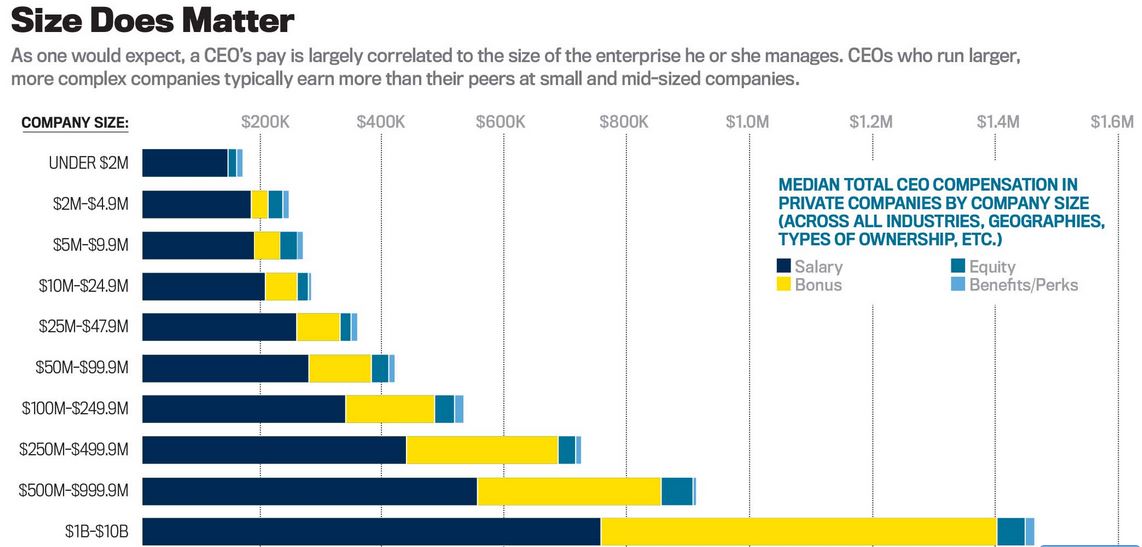

The science and art of benchmarking salaries ensures that a company compensates their top employees at a competitive level. The scientific portion revolves around data collected by benchmarking providers such as Willis Towers Watson, Mercer, Radford, Aon Hewitt, and many more. These data tables are built up through salary surveys across countries, industries, jobs, levels of responsibly, company revenues, etc. Thus in a fairly standardized way, one can use the table to give a general impression of the value of a certain position. One looks at revenues, profits, market cap, headcount, people responsibility and many other data points. Thus the Salary benchmark of an HR head for a Swiss company with a CHF 10 billion revenue will be vastly different to that of a Swiss based HR Head of a multinational with a revenue of CHF 50 billion. The "Art" part of benchmarking salaries is an understanding of these tabulations, war for talent, attraction and retention.

Companies use peer groups to gain insight and help set executive pay ranges in comparison to its competitors. Generally, peer groups used for benchmarking are selected to reflect the target company in some way. Peers usually include close competitors or companies of a similar size, stature, or geographical location.

Thus logically if the Novartis Benchmarks are currently correct, then Novartis minus Alcon reduces the Benchmark for the various top jobs, both by the external salary surveys and Novartis‘ position in their peer group. Top level corporate salaries must fall. Novartis has reaped disapproval in the past for setting indiscriminate salaries and many contend that because of this, was in part responsible for a tectonic shift in compensation practice in Switzerland. by way of the Minder Initiative.