Credit Suisse – the rot within – part 1

The Guardian Newspapers defined Credit-Suisse as „Crooks, kleptocrats and crises“, and listed the many scandals of Credit-Suisse, but which they always seemed to survive, even if their relationships with crooks, money launderers and corrupt politicians were exposed (Guardian).

To name some of the larger ones:

1986: Fake names for Ferdinand and Imelda Marcos

1999: Japanese ‘shredding party’ where bankers destroyed evidence related to an investigation into whether it was helping companies conceal their losses.

2000: Banking funds linked to a Nigerian dictator

2004: Money laundering for the Japanese yakuza

2009: US sanctions breaches - Credit Suisse was fined $536m for deliberately circumventing US sanctions against countries including Iran and Sudan between 1995 and 2007.

2011: German tax evasion

2012: US sub-prime bond fraud & facilitating tax evasion by US citizens.

2014: US tax evasion - Credit Suisse was fined $2.6bn and pleaded guilty to helping Americans evade taxes

2016: Italian tax evasion

2016: Money-laundering fine

2017: Money-laundering fine related to 1MDB

2017: European tax evasion

2018: Weak controls linked to dealings with Petrobras, PDVSA and Fifa

2018: Lescaudron fraud conviction. Former Credit Suisse banker, Patrice Lescaudron, was sentenced to five years in prison after admitting to forging client signatures to divert money and make stock bets without their knowledge, causing more than $150m in losses. Lescaudron killed himself in 2020.

2018: Hong Kong jobs-for-business scandal

2019: Corporate espionage & trees blocking the view. The bank was caught in a corporate espionage scandal, and eventually admitted to hiring private detectives to track two outgoing executives. It triggered a regulatory investigation and culminated in the departure of its chief executive, Tidjane Thiam, in 2020. Also exposing petty private infighting between Credit-Suisse executives.

2020: Bulgarian drug trafficking. Credit Suisse failed to run proper checks on clients and investigate the source of funds linked to a Bulgarian drug ring that allegedly laundered at least $146m through accounts between 2004 and 2008.

2021: Archegos collapse

2021: Greensill scandal

2021: Mozambique tuna bonds

2022: Chairman António Horta-Osório resigns after questionable personal behavior: ‘I regret that a number of my personal actions have led to difficulties for the bank.’

One wonders what else the Credit-Suisse Risk Managers were not doing?

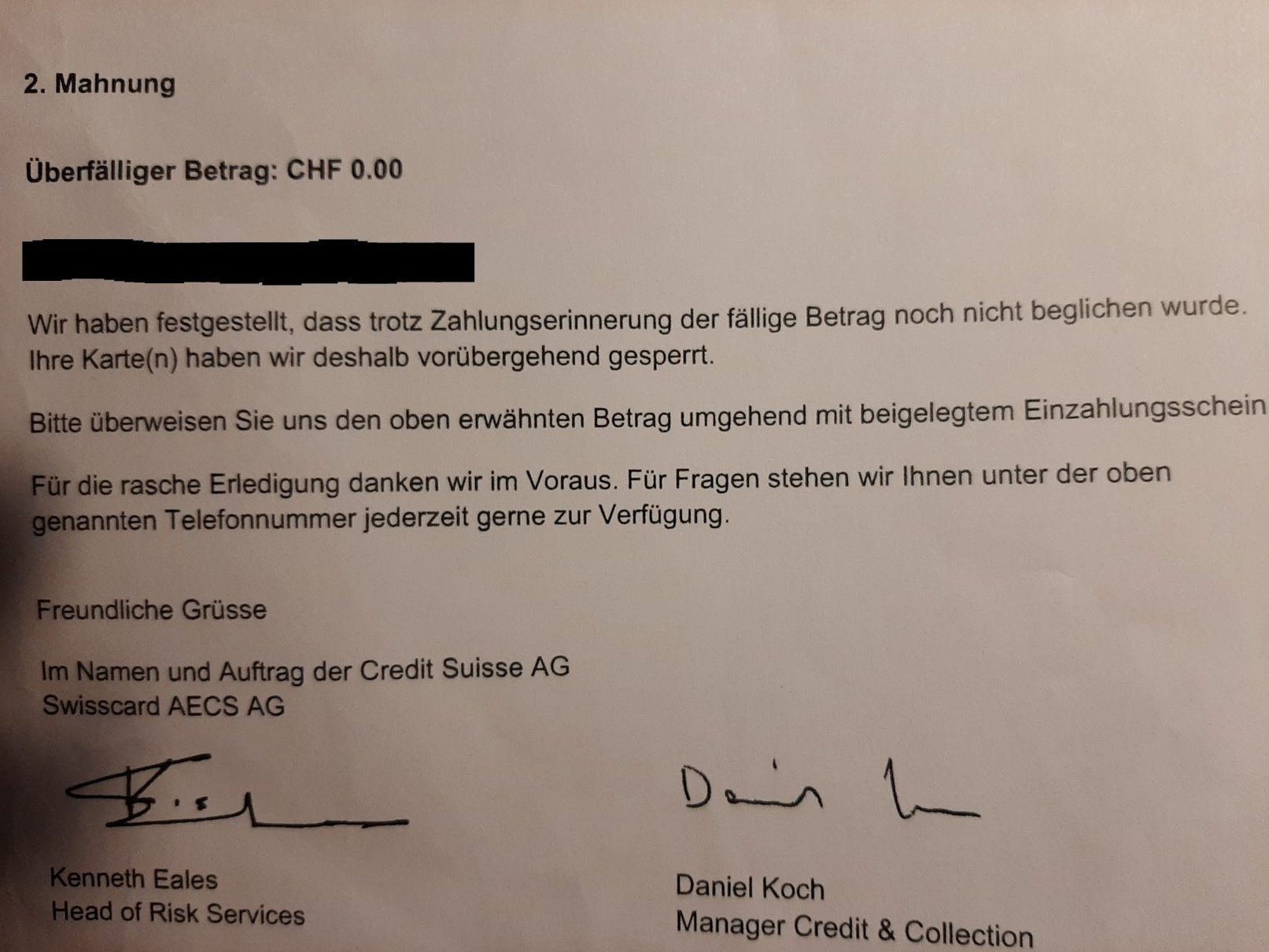

A few years ago, our members who were Credit-Suisse customers received received a threatening letter and had their cards blocked in a mind boggling action where a „Second demand“ letter was received because they had an outstandimg amount of 0.00 Swiss Francs. (of course there had been no "first demand" letter)

This was signed by Kenneth Eales, Head of Risk Services, and Daniel Koch, Manager of Credit and collection.

Astounding! And of course there was no apology or explanation to customers, who particularly had the embarassment and surprise of cards being inexplicably denied when they were standing in lines trying to pay, as well as a huge heap of disruption and disturbance. Can Credit-Suisse have been surprised customers were abandoning them?

You would think a Head of Risk Services would be more diligent, as well as having more important issues to attend to.

This was the moment we knew that the only direction Credit-Suisse was heading was downwards.

UBS should take the remaining customers and assets of Credit Suisse, but in other areas they need to turn over a new leaf, and start with a clean slate.

Just wait - it gets far worse!