Credit Suisse – Messy House?

A few years ago Credit Suisse sent me a final DEMAND letter threatening dire consequences if I did not settle my outstanding balance. They already blocked my cards. The letter was signed (passive/aggressive?) by Kenneth Eales – Head of Risk Services and Daniel Koch – Manager Credit and Collection.

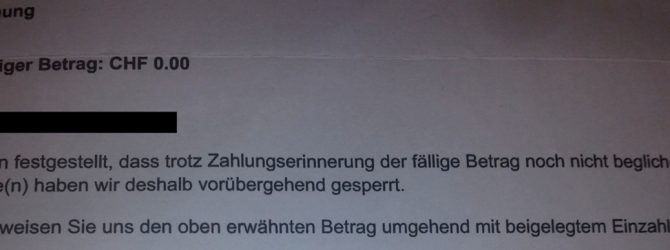

Only thing, was that I never received any previous notices of an outstanding payment? In fact I always paid invoices on time and kept a positive balance at Credit Suisse, thus this letter of demand was somewhat surprising, to say the least. Such late payment does not factor in my personal finances. Oh yes, you are wondering what this excessive amount I had outstanding was? Valid question, it was 0.00 Swiss Francs!

After calling the Credit Suisse hotline to find out what was going on, and having a pleasant young lady on the other end laugh nervously and say „Oh yes, we sent similar erroneous letters to a few thousand people“, I remember asking myself, just how disorganised and uncontrolled is Credit Suisse internally. A small apology from Credit Suisse would also have been welcome! My cards were unblocked!

Well now we have an insight into how the internal processes at Credit Suisse may be disorganised and uncontrolled:

Three former Credit Suisse bankers have been charged by US prosecutors with alleged fraud and receiving kickbacks in connection with a $2 billion loan to Mozambique.

Credit Suisse has so far not been charged. Credit Suisse released a statement saying that the trio “worked to defeat the bank’s internal controls, acted out of a motive of personal profit, and sought to hide these activities from the bank. Credit Suisse will continue to co-operate with relevant regulators following these indictments, and separately looks forward to continuing to work with the relevant authorities to move forward with the proposed debt restructuring”.

The US attorney’s office has alleged that the three former Credit Suisse bankers acted “within the scope of their employment” and that they intended, in part at least, to benefit the bank. These are two key tests prosecutors have to meet to find a company liable for the actions of its employees.

This does beg a question regarding Credit Suisse’s due diligence and internal oversight? This is after all a $2 billion mess.

The three former employees of Credit Suisse - Andrew Pearse, Detelina Subeva and Surjan Singh - were arrested in London on Thursday 3 January 2019 and later released on bail. The US attorney’s office for the eastern district of New York is seeking their extradition over alleged money laundering and defrauding of US investors in the loans.

Manuel Chang, Mozambique’s finance minister at the time of the loan deals, was arrested in South Africa on Saturday 29 December 2018 in connection with the indictment. The charges stem from this 2013 deal for Mozambique, to borrow from international investors ostensibly to fund maritime projects, including a state tuna fishery, and in offshore gas. The loans were partly concealed from the International Monetary Fund and international donors, before they collapsed.

Mr Chang and the bankers “created the maritime projects as fronts to enrich themselves and intentionally diverted portions of the loan proceeds” to fund $200m of bribes and kickbacks, according to the indictment. The indictment charged four counts of conspiracy to commit money laundering, conspiracy to violate the US Foreign Corrupt Practices Act, conspiracy to commit securities fraud and conspiracy to commit wire fraud. Mr Chang was not charged on the FCPA conspiracy count.

The IMF and international donors cut off support for the government’s budget after the loans were discovered in 2016, destabilizing one of Africa’s fastest-growing economies.

Auditors discovered that $500 million of the money raised by the loans could not be accounted for and that the companies behind the debt paid over the odds for equipment. Mozambique eventually defaulted on the debts, which are being restructured. Credit Suisse is advising investors in the loans. Credit Suisse’s position is that their former employees allegedly deceived investors over the loans’ true purpose and circumvented the bank’s internal controls to conceal the alleged fraud. The indictment accused the bankers of using personal emails to conceal their activities and misleading the bank over the nature of the companies behind the loans.

Prosecutors also charged Jean Boustani, an executive of Privinvest, an Abu Dhabi-based group that supplied (substantially overpriced) boats and gear to the projects, with three counts of conspiracy. Mr Boustani was arrested in New York on 2 January 2019 and ordered detained, according to the spokesperson for the US attorney’s office. Mr Pearse and Ms Subeva left Credit Suisse to work for Privinvest in 2013.