Novartis downgraded by Analysts

Gone is the euphoria from the start of 2018 where many analysts were bullish about Novartis and its new young prince.

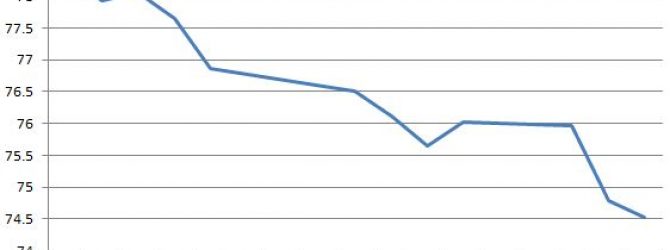

Scandal upon scandal has had an impact. From the disclosure around 2 weeks ago regarding the $99‘980 monthly payments (the amount, according to many reporting news outlets points to the intent of deception) amounting to around $1.2 million, up to today, 30 May 2018, the value of Novartis has decreased around $ 6 Billion. This payment scandal has allegedly had no real or obvious accountability from involved persons. Novartis claims „the issue is now closed“; plummeting shares tell a different story.

Analysts as well are seeing Novartis in a different light. HSBC has cut the rating for shares of Novartis to a “Hold” in a research report sent to investors on 29 May 2018. NVS’s previous rating by the firm was a “Buy”.

"Given the expected regulatory approvals for Kymriah in DBLCL and Aimovig and the likely thin news on ASCO, HSBC's analysts are only expecting a limited number of catalysts in the short term that could drive Novartis AG's stock price.

As part of a reduction in profit projections, the analyst Julia Mead lowered the price target for the Novartis share. There is hardly any upside potential left. "

Among other analysts covering Novartis, 0 have Buy rating, 1 Sell and 3 Hold. Therefore 0 are positive. Bank of America already a couple of months ago downgraded the shares of NVS in report to “Sell” rating. Novartis has a “Hold” rating by Cowen & Co, and a “Market Perform” rating by Leerink Swann.

German finance portals carry the headline this last week of May 2018 „Novartis-Aktie geht die Luft aus!”