Share Buybacks – a success for Novartis ?

Occasionally, a company will choose to buy back shares of its stock. This is called a buyback, or share repurchase program.

When a company reduces the number of shares outstanding by declaring a stock buyback program, each of the shares should in theory become more valuable and represents a greater percentage of equity in the company.

Buybacks take the risk out of capital allocation. There’s no guarantee that a dollar invested in new products, geographic expansion or factory capacity will produce an acceptable return. Share buybacks, by contrast, almost always bolster the number CEOs care about most: earnings per share. Reducing share count lifts EPS, even if actual earnings stagnate or decline. And that props up share prices, which are based on EPS.

Pitfalls

Stock buyback programs are not good if the company pays too much for its own stock. Even though buybacks can be huge sources of long-term profit for investors, they are harmful if a company pays more for its stock than it is worth. In an overpriced market, it would be foolish for management to purchase equity at all, even in itself.

Rather, the company should put the money into assets that can be easily converted back into cash. Thus, when the market swings the other way and is trading below its true value, shares of the company can be bought back at a discount, ensuring current shareholders receive maximum benefit. Even the best investment in the world isn't a good investment if you pay too much for it.

Possible Public Relations Backlash

Share buybacks are not always met with rousing applause. While they can sometimes make investors happy, there is always a risk that the public and investors will question why profits are being spent to boost shareholder value instead of investing back into the company or paying workers more money. Thus, some companies will choose not to buy back shares simply to avoid bad publicity.

Good or bad?

Buybacks can also be a bad sign. Share buybacks, like any expenditure, are capital allocation decisions. When execs decide to perform buybacks, they’ve concluded that investing the same amount in business operations would be a poorer use of capital.

Executives may hope markets will interpret rising buybacks as a sign of confidence. Theoretically, companies buy their own stock when management believes business prospects are better than share values indicate. In other words, they expect stronger fundamental performance to lift the shares.

Real-world experience suggests otherwise. First of all, companies are notoriously bad stock pickers. Studies show they tend to buy back shares at highs, not lows. Secondly, other research indicates companies that repurchase lots of stock generally underperform those that don’t buy back their own shares.

Critics say buybacks reflect not optimism of executives, but anxiety. Buybacks can be seen as a defensive measure during times of uncertainty. Share repurchases soar in years of sluggish growth e.g. like those that followed the deep recession of 2008-09. CEOs lacked confidence in demand, so they bought back shares instead of wagering on an economic rebound.

Novartis Share Buybacks – good or bad / success or failure?

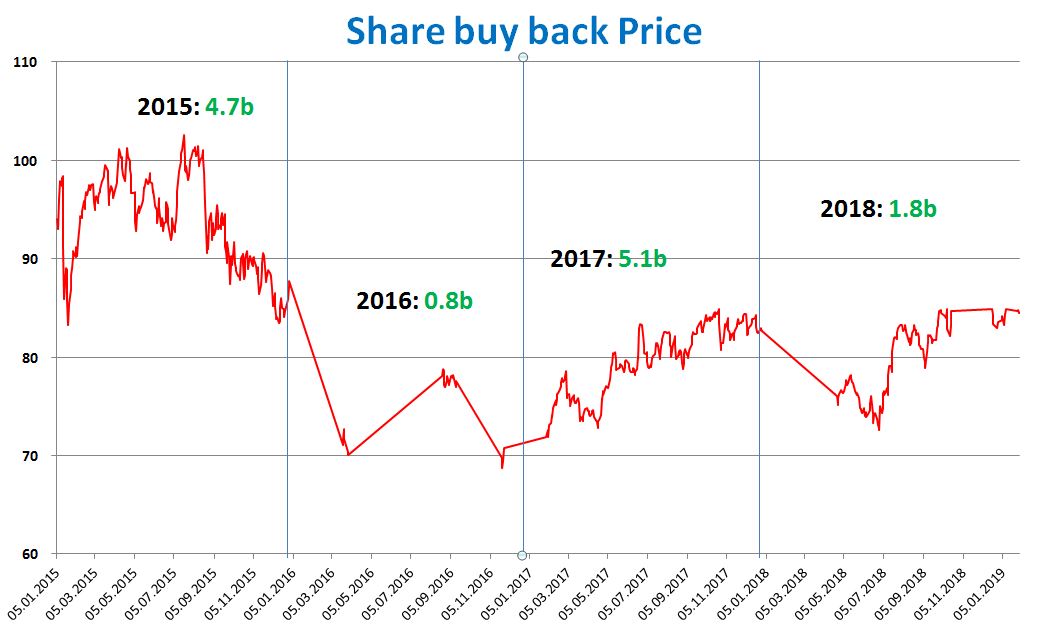

Consider the chart below and understanding the above text, one can come to a conclusion.