Try lying to the US Senate and Department of Justice?

Even more problems for Credit Suisse:

The US Senate and Department of Justice are aiming at reconsidering the “friendly deal” it made with the Credit Suisse in 2014 over a tax dispute where the Credit Suisse actively helped rich United States citizens hide their money so as to avoid paying US Taxes.

.

Based on evidence from a whistleblower, an ex Credit Suisse banker, it is alleged that Credit Suisse withheld additional information from the US Senate and Department of Justice while reaching the agreement. Specifically it is alleged that, Credit Suisse continued to hide the accounts of wealthy USA clients from the Department of Justice. The example given is of a US-Israeli economics professor named Dan Horsky – who was also later convicted of his own tax offenses. Credit Suisse had helped him hide hundreds of millions of dollars from the US authorities while telling US authorities they had made a full disclosure.

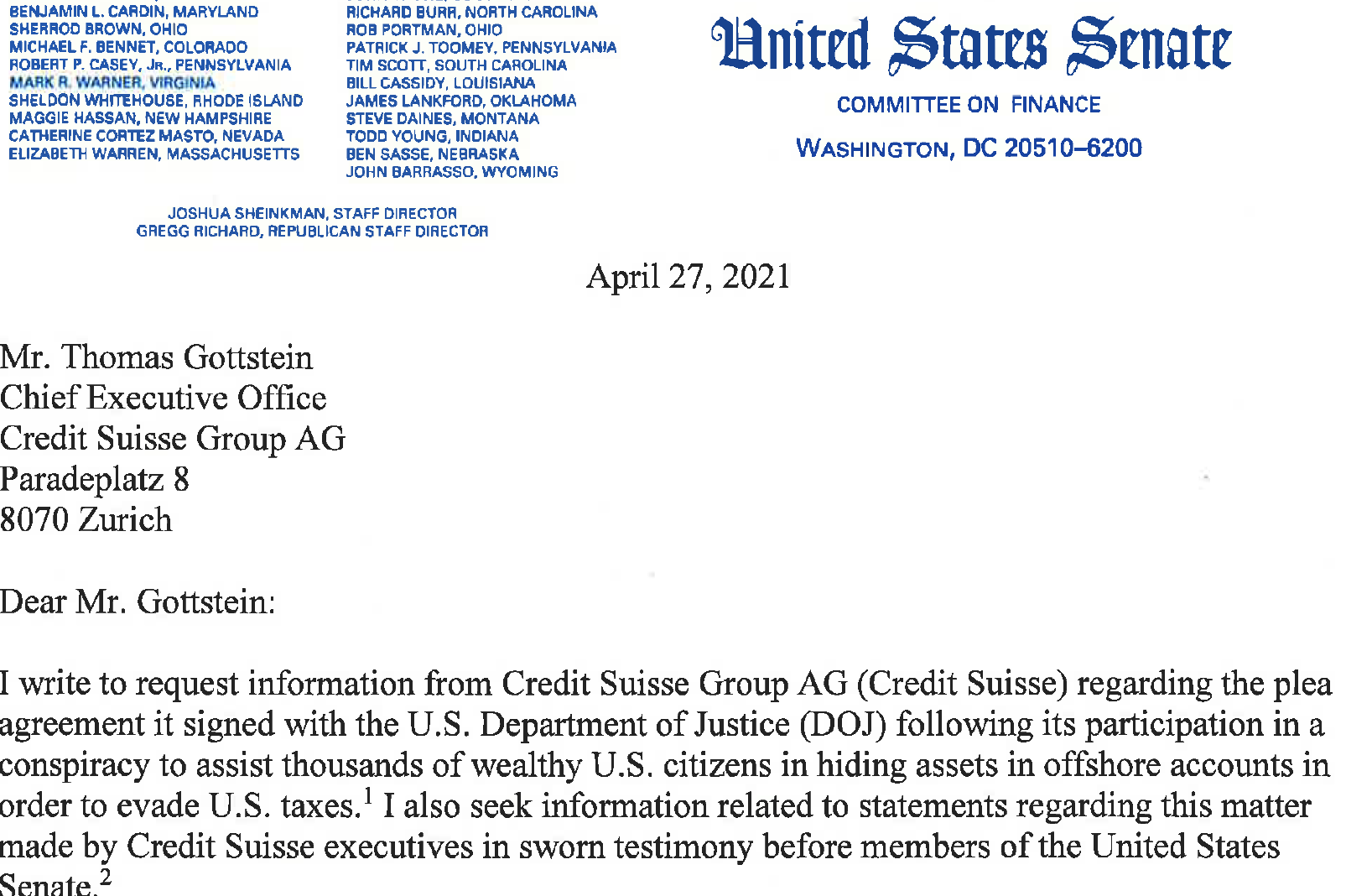

An investigation from the "Financial Times" has discovered that the finance committee of the US Senate is questioning the agreement reached by Credit Suisse in the US tax dispute. This dispute over untaxed US taxpayers' money was resolved with Credit Suisse with a payment of $ 2.6 billion to the Department of Justice.

Committee Chairman Senator Ron Wyden is now calling on Attorney General Merrick Garland to provide additional information on this 2014 deal in the light of these new allegations against Credit Suisse.

Senator Ron Wyden also contacted CS CEO Thomas Gottstein directly: New documents raised doubts that Credit Suisse had fully adhered to its agreements with the Department of Justice, the letter from Washington said. If the Justice Department re-opens the dispute with the CS, the bank threatens serious consequences - in the worst case, the bank could (at least temporarily) lose its business license for the USA,

Credit Suisse is already in another deep crisis of their own making: the scandals surrounding the US hedge fund Archegos and the British finance company Greensill Capital have caused the big bank to lose billions. The problems just keep coming!